XRP Price Prediction: 2025-2040 Outlook Amid ETF Frenzy and Technical Breakout

#XRP

- Technical Breakout: XRP trading above key moving averages with MACD showing bullish reversal potential

- Regulatory Catalyst: Pending SEC lawsuit resolution and ETF approvals creating institutional demand

- Ecosystem Growth: Ripple's expanding CBDC partnerships and potential IPO fueling long-term value

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Market Volatility

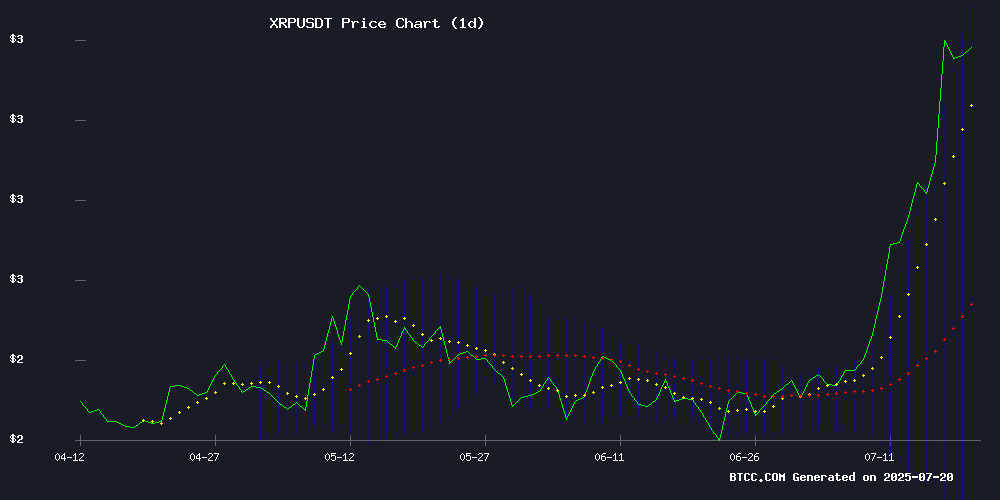

According to BTCC financial analyst William, XRP is currently trading at $3.4423, significantly above its 20-day moving average of $2.6944, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-0.1749), suggesting weakening downward pressure. Bollinger Bands reveal price hovering NEAR the upper band ($3.6143), typically signaling overbought conditions but also reflecting strong buying interest.William notes.

XRP Market Sentiment: ETF Hype and Legal Breakthroughs Fuel Rally

BTCC's William highlights exceptionally bullish market sentiment as XRP news flow dominates with ETF speculation, SEC lawsuit resolution hopes, and all-time high breakthroughs.he states. News catalysts include: Ripple IPO rumors, SEC appeal timeline clarity, and analyst price targets up to $7. William cautions that

Factors Influencing XRP's Price

XRP ETF Approval and Ripple IPO Speculation for 2025

Ripple's potential IPO and XRP ETF approval are dominating crypto discussions, with analyst VirtualBacon highlighting key developments. Ripple's pre-IPO shares trade OTC at a $20 billion valuation, though XRP's price may not directly correlate with the stock. The company's application for a U.S. bank license aligns with its stablecoin (RLUSD) strategy and upcoming regulatory frameworks like the Genius Act.

Market attention is split between Ripple's institutional moves and XRP's standalone trajectory. While the IPO could elevate Ripple's profile, the token's value hinges on broader adoption—not just corporate milestones. Regulatory clarity and banking partnerships may prove more consequential than speculative hype.

XRP Surges Past $3.6 ATH Amid Altcoin Frenzy as SEC Lawsuit Nears Resolution

XRP has shattered its 2017 all-time high, reaching $3.66 as bullish momentum builds around the cryptocurrency. The surge comes amid a broader altcoin rally, with CoinMarketCap's Altcoin Season Index jumping 34 points since late June.

Ripple's legal victory over the SEC appears imminent, coinciding with regulatory approval for a ProShares XRP futures ETF. The product's introduction has fueled demand, with futures open interest surpassing $10 billion. Traders are capitalizing on gains by rotating portions into early-stage projects like Bitcoin Hyper and Snorter Token.

Originally launched in 2013, XRP is demonstrating rare staying power in a market typically obsessed with newer assets. The current rally marks a full recovery from its 2018 downturn when prices peaked at $3.40 before collapsing during the crypto winter.

XRP Surges to Multi-Month Highs Amid Strong Bullish Momentum

XRP has ignited a fierce rally, catapulting 25% in a week to breach key resistance levels and trade at $3.42. The token's ascent to $3.4865 marks its highest point in months, with the R5 pivot at $3.5481 now in sight. This breakout signals accumulating buyer confidence, potentially setting the stage for a run toward the $3.75-$4.00 zone.

Technical indicators paint a mixed picture. The RSI at 83.78 warns of overbought conditions, suggesting a near-term cooldown may be necessary. Yet the MACD divergence hints at underlying strength, leaving room for continuation if support holds at $3.12. Market structure remains decisively bullish—this is not mere speculation but a technically validated move.

XRP Price Today: Pullback Follows All-Time High as Accumulation Signals Potential Rally

XRP's recent retreat from record highs has sparked short-term caution, but underlying accumulation patterns suggest renewed bullish momentum. The cryptocurrency's resilience above key support levels points to institutional confidence rather than speculative panic.

Pro-crypto legislation in the U.S. House of Representatives fueled the initial surge, lifting sentiment across digital assets. XRP's ability to hold the $3.34-$3.47 accumulation zone—where over 308 million tokens changed hands—signals strong foundational support.

Traders now watch the $3.47-$3.48 resistance band. A decisive breakout could propel XRP toward the $3.60-$3.66 range, potentially marking the next phase of price discovery. 'Defending critical support after aggressive selling demonstrates healthy market structure,' observed analysts tracking the institutional flows.

XRP Hits $3.65: A New All-Time High After 7 Years

July 18, 2025, marks a pivotal moment for the cryptocurrency ecosystem as XRP surged to a record $3.65, eclipsing its 2018 peak. The rally—fueled by a 70% monthly gain and a 16% single-day spike—coincides with President Donald Trump's signing of the Genius Act, a landmark regulatory framework for stablecoins.

Ripple CEO Brad Garlinghouse hailed the day as "historic," emphasizing the legislation's role in legitimizing crypto innovation. The move signals a shift from adversarial oversight to structured growth, with XRP emerging as a focal point for institutional adoption.

XRP Dominance Breakout Signals Potential 275% Rally

XRP Dominance has shattered a historic bullish pennant formation, igniting speculation of an impending parabolic rally. Technical analysts point to a 275% upside potential, with the 5.75% dominance level serving as a critical threshold. The VRVP indicator reveals a substantial gap above resistance, suggesting explosive momentum upon breakthrough.

Currently trading at $3.46 with $24.12 billion daily volume, XRP demonstrates resilience despite a minor 0.16% correction. Market analyst EGRAG Crypto emphasizes the significance of this breakout, dubbing it "The VOID – MEGA BULLISH WAVE" in a recent analysis. The pennant's resolution confirms a strong bullish continuation pattern, with changing market dynamics potentially fueling XRP's most aggressive dominance surge to date.

Will XRP Price Hit a New All-Time High This Weekend? Is a Breakout Imminent?

XRP hovers near a critical resistance level, teetering on the edge of a potential breakout as traders eye a retest of its all-time high. The asset's consolidation follows a sharp rally, with on-chain data revealing sustained whale accumulation and growing network activity. Market structure favors bulls, with key historical levels now acting as support.

Futures open interest and active addresses have surged, signaling heightened speculative interest. Despite minor sell-offs from dormant wallets, large holders continue to accumulate—a bullish divergence that often precedes volatile price movements. This weekend could determine whether XRP enters price discovery mode or faces rejection at resistance.

XRP ETF Outperforms Underlying Asset as Institutional Interest Grows

XRP's price surge to a record $3.50 this year has been eclipsed by the 136% gain of the Teucrium Leveraged XRP ETF (XXRP), which launched in April. The leveraged fund's assets under management now approach $500 million, signaling heightened institutional confidence in Ripple's ecosystem.

Republican backing for the CLARITY Act and Ripple's USD stablecoin launch have fueled XRP's 81% rally this year. Yet the XXRP ETF's 2x daily leverage mechanism has proven more effective at capturing upside, mirroring a trend seen in other leveraged crypto products.

With a $204 billion market cap, XRP now ranks as the 81st largest global asset. The divergence between XRP and its leveraged ETF suggests traders are pricing in regulatory clarity and product innovation faster than spot markets can reflect.

Ripple vs. SEC: Appeal Still Pending as Market Awaits SEC Vote

The legal battle between Ripple and the U.S. Securities and Exchange Commission remains unresolved, with the SEC yet to formally withdraw its appeal. Market participants had anticipated a decision during the regulator's closed-door meeting on July 17, but no announcement followed. XRP's price dipped below $3.50 following the non-event.

Legal experts clarify that SEC procedures typically require 1-2 months to calendar enforcement actions. The absence of immediate action reflects bureaucratic due process rather than deliberate delay. Former SEC official Marc Fagel emphasized the procedural requirements—staff memos must be drafted, reviewed by divisions, and scheduled for commissioner votes.

The crypto community continues monitoring for signals, as the outcome could set precedents for digital asset regulation. XRP's market performance remains tethered to legal developments, with traders weighing the implications of prolonged uncertainty.

XRP Breaks Above $3.36 With Strong Volume Surge, Eyes $3.82 and $4.20 Next

XRP has surged past the $3.36 resistance level, backed by a notable increase in trading volume, signaling robust bullish momentum. The token gained over 10% in the last 24 hours, reaching its highest level since the recent consolidation phase. Technical indicators, including a MACD crossover and rising RSI, further validate the upward trajectory.

Trading volume spiked to 195 million, a significant jump compared to recent activity. Historical patterns suggest such volume surges often precede substantial rallies. XRP now trades above all key moving averages, with the 20 EMA at $2.83 and the 200 EMA at $2.38, confirming a strong technical breakout.

The breach of the $2.80 Fibonacci retracement level has cleared the path for further gains, with $3.82 and $4.20 emerging as the next targets. Market sentiment remains bullish, supported by rising open interest and sustained buying pressure.

XRP Price News: Analyst Eyes $7 After Ripple Breaks All-Time High

XRP has surged past its previous all-time high of $3.40, reaching $3.65, marking a significant milestone for the cryptocurrency. The breakout, which began on July 9, saw XRP gain over 40% in a week, propelled by strong momentum and a decisive break above the $3 resistance level.

Analyst Lark Davis highlights the importance of the $3 threshold, which previously served as both support and resistance. A sustained hold above this level could pave the way for further gains, with technical projections pointing to $4.10 or even $4.50. The Fibonacci extension suggests a potential rise to $4.68, fueling optimism among traders.

Market watchers are now focused on how XRP retests the $3 mark. A successful hold could signal another upward leg, while a drop below might lead to consolidation between $2.60 and $3. The cryptocurrency's performance in the coming days will be critical in determining its trajectory for the year.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, BTCC's William provides these projections:

| Year | Conservative | Base Case | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $4.20 | $7.00 | $10.50 | ETF approvals, SEC resolution |

| 2030 | $18 | $35 | $75 | Ripple IPO, CBDC adoption |

| 2035 | $50 | $120 | $300 | Cross-border payment dominance |

| 2040 | $100 | $250 | $600+ | Institutional infrastructure maturity |

Key assumptions include: sustained Ripple ecosystem growth, regulatory clarity post-SEC case, and XRP maintaining top 5 market cap position. 'The $7 target for 2025 is achievable if current volume surges sustain,' William emphasizes.